Emerging from a period of economic and financial instability, one thing has become abundantly clear, Australians are hungry for sustainable investment.

This observation was confirmed last week by Australian research organisation Investment Trends through an audit of 2,854 retail investors and 321 financial advisers. One of the most significant findings, especially for financial services firms such as ours, was that 78% of ESG investors intend to trade stocks and funds solely based on environmental factors in 2021, a rise of 34% on the previous year’s reporting.

Surprisingly, while Australian investors seem to have an insatiable appetite for strong ESG standards and climate friendly investment, only 40% (approximately) of financial advisers were reported as actively recommending ESG investment to clients over the previous year. The report explained the hesitance, “Placed at the intersection of clients who are demanding more ESG investments and the firms trying to deliver, financial advisers are uncertain about how it will all play out”.

Investment Trends went on to note that improved reporting would ease some of these anxieties and help advisers feel more confident in recommending ESG compliant investment.

Standardisation and regulation on ESG reporting would be a positive step for the industry in Australia. Such action has already been taken in Europe with the introduction of the Sustainable Finance Disclosure Regulations (SFDR), which are expected to lead to the following benefits:

- No Green Washing. Fair and honest regulation addresses misleading reporting from organisations who take advantage of loose standards for environmental, social and governing responsibility.

- Increased investor confidence. It has been shown that companies and funds who adhere to strict and honest ESG standards mostly out-perform those who do not. This assessment verified by Morningstar, which found that 89% of sustainable indices outperformed their broad market equivalents in Q1 2020. With increased visibility of these results, investors and advisors alike feel encouraged to make a positive and profitable investment in the future.

- A better Australia for Australians. Standardisation and accountability in reporting means that companies and fund managers are required to show directly how their investments and actions effect society positively and provide environmental benefit for generations of Australians to come.

At Vellum, we are dedicated to delivering exceptional outcomes for clients, excellent returns to investors and importantly positive, transparent impact to people and the planet.

The invited speakers at the conference were experts from different sectors, including government, superannuation bodies, investment funds, big-four accounting firms and specialised law firms. Besides Binuo, other speakers included:

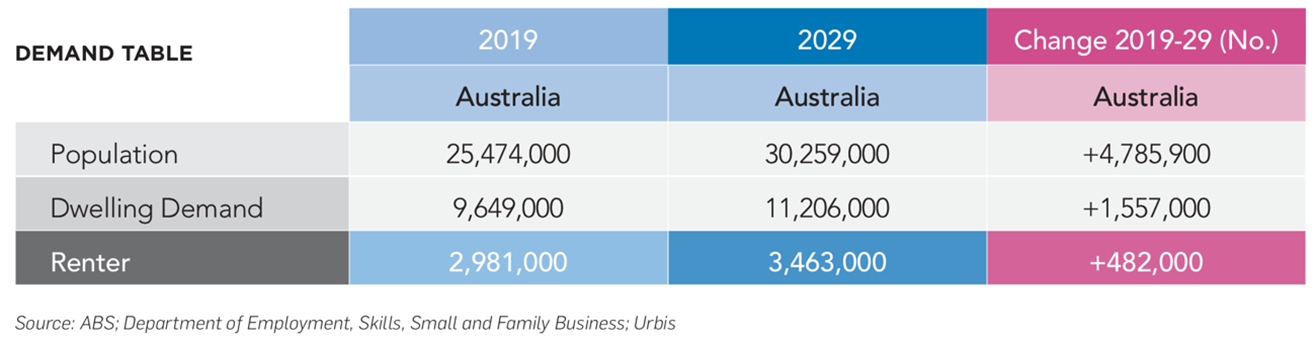

The invited speakers at the conference were experts from different sectors, including government, superannuation bodies, investment funds, big-four accounting firms and specialised law firms. Besides Binuo, other speakers included: Australian residential property, within which build-to-rent is an asset sub-class, is a well-developed real estate market with an excellent track record of delivering strong outcomes for residents and investors. As Binuo pointed out, Vellum sees areas like Sydney’s western corridor continuing their growth as desirable places to live. Australia has handled both the Global Financial Crisis and now the COVID-19 pandemic incredibly well, while the property market has been reliable even in the face of such crises.

Australian residential property, within which build-to-rent is an asset sub-class, is a well-developed real estate market with an excellent track record of delivering strong outcomes for residents and investors. As Binuo pointed out, Vellum sees areas like Sydney’s western corridor continuing their growth as desirable places to live. Australia has handled both the Global Financial Crisis and now the COVID-19 pandemic incredibly well, while the property market has been reliable even in the face of such crises.