Home ownership declines as BTR rises

As home ownership levels in Australia continue to decline, especially among younger generations living in expensive major cities like Sydney and Melbourne, a new Australian dream is emerging in the form of the build-to-rent (BTR) asset class. As 2021 dawns, so too does for the welcome chance to replicate the success of BTR already experienced in the UK and USA (where BTR is commonly known as ‘multifamily’), an asset class with extensive developments which are accelerating as demand continues to increase.

Vellum has been an early adopter of BTR, with the success of its first project Highland that has been almost fully tenanted with steady five percent returns for investors since completion 18 months ago, even during the Covd19 pandemic. Our newest BTR development, also in Sydney’s western suburbs hub of Penrith, Navali is also on track to have similar if not greater economic, environmental, and social success once completed in 2021.

The three primary reasons why housing markets globally are changing from higher home ownership to long-term rentals comes down to generations now in their 20s and 30 delaying partnering and children, and their desires to live close to city centres longer, compounded by a relentless rise in Australian housing costs.

This has led to long-term renters making up over a third of the housing markets in the UK, USA, and Australia.

What the USA and UK experiences tell Australian BTR investors

As Australia continues to grapple with how to address this changing housing landscape, it is comforting to know more mature international markets have had success through BTR developments, which work well for investors and long-term renters alike.

The US, which has the most mature multifamily market, has over 14.5 million units across 62 large markets, with an acquisition volume of US$150 billion in 2017 alone[1]. In 2019 the multifamily market reportedly contributed US$3.4 trillion to the US economy and supported 17.5 million jobs[2], accounting for more than 25% of real estate investment[3].

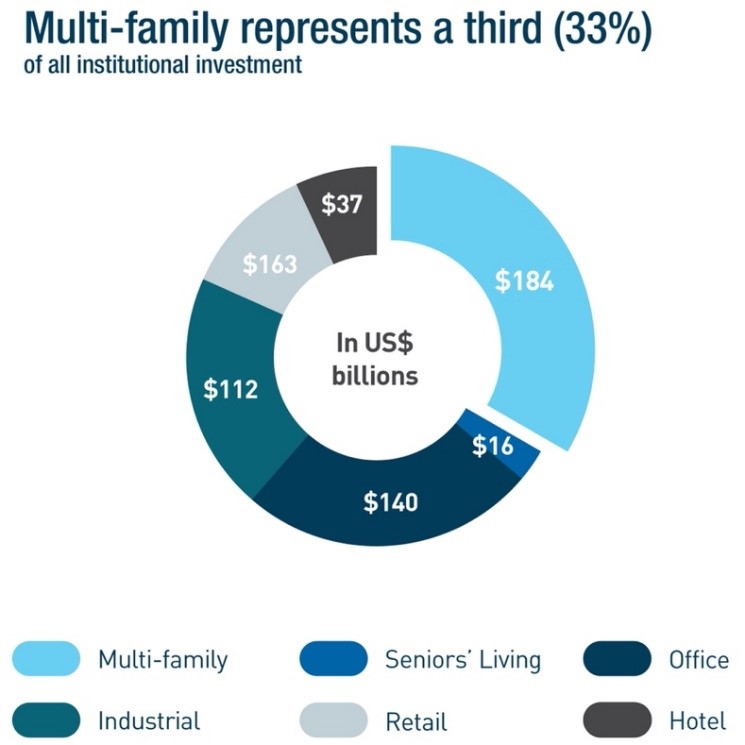

Even with the economic challenges faced by investors due to COVID-19, 280,00 units or more will be developed in 2020[4]. For institutional investors, BTR development has become a major investment class, representing 33% of all development investments.

This is because the average income return was 6.8%, where even during the global financial crisis average returns were 5.5%[5].

This overall success is made possible due to market led financial system in the US. As the asset class has developed with returns and demand steadily increasing, financial institutions have established dedicated arms to multifamily lending[6].

It is expected that by 2030 an additional 4.3 million additional multifamily units are required to keep up with demand, that is about 328,00 new units each year[7].

Similarly, the UK market has started to flourish over the past decade, while still relatively immature compared to the US, it has accelerated with over £10 billion in investment over the past five years. To date the UK market has completed 48,000 BTR homes with 34,000 currently under construction.

Like the US market, the UK BTR stock development is accelerating rapidly. Currently there are 162,000 BTR homes planned, this is a pipeline increase of 500%[8].

In 2020, UK BTR investments were expected to reach £70 billion. However, expectations are that this will exponentially increase in the coming years to be potentially over 1.7 million households with a maturity of £540 billion[9].

The value of governments and investors working together

While Australia BTR is a still a young emerging concept, it is hot on the heels of the growth of the US and UK markets. It now needs added support and partnership to really soar.

For example, the UK government has developed bespoke market interventions aimed at improving viability of new BTR developments and attract additional institutional investment. One primary change is the separation BTR as a different asset class, separating it from to build-to-sell. This has changed planning mindset and created a framework allowing BTR to thrive as its own asset class[10].

The Australian view into 2021 is one that remains confident of the BTR market can rely on similar overseas success, providing a positive solution which benefits both investors and tenants for the long term.

We just need to make it a reality.

[1] http://www.dfpartners.com.au/wp-content/uploads/2018/07/180709_DFP_Build-to-Rent_eBook_v1.pdf

[2] https://www.colliers.com.au/download-research?itemId=5f412cac-90c1-4f53-8031-8cd69af74f3e

[3] https://www.ashurst.com/en/news-and-insights/insights/build-to-rent/

[4] https://www.realtymogul.com/knowledge-center/article/2020-multifamily-housing-trends

[5] https://www.afr.com/companies/infrastructure/building-to-rent-is-now-an-asset-class-20191108-p538vs

[6] http://www.dfpartners.com.au/wp-content/uploads/2018/07/180709_DFP_Build-to-Rent_eBook_v1.pdf

[7] https://www.realtymogul.com/knowledge-center/article/2020-multifamily-housing-trends

[8] https://www.colliers.com.au/download-research?itemId=5f412cac-90c1-4f53-8031-8cd69af74f3e

[9] https://www.savills.com.au/blog/article/184167/outlooks-and-trends/australia-hot-on-the-heels-of-uk-s-decade-long-build-to-rent-growth-spurt

[10] https://www.thefifthestate.com.au/innovation/residential-2/build-to-rent-in-australia-what-lessons-can-be-learnt-from-the-uk/

[11] https://www.cromwellpropertygroup.com/research-and-insight/research/the-emergence-of-build-to-rent-in-australia